How will BREXIT affect my orders from Darkside?

As of 31st December 2020, the UK will be leaving the European Union, we would like to reassure all of our European customers that our ability to ship orders will not be affected.

In the simplest of terms, the only real change you will see is around taxes and duties. Instead of paying us the UK VAT @ 20%, we will sell the goods without VAT, then the taxes will be paid by yourself upon import at your local rate. If you are VAT registered in your country, you would then claim this back like any other import.

A full list of affected countries are listed at the bottom of this page. We have also included the local translation for VAT for each.

As there has now been a deal, there should be no further duties to pay on Import, although we are waiting for further clarification on this.

Most carriers are also going to be charging a fee for handling the transaction, DHL for example is £11 or 2.5% of the amount owed, whichever is greater.

We are continuing to use DHL Economy and Express, just as we do for the rest of the world. We welcome feedback from customers on the new process experience going forward.

We have been exporting globally for over 10 years so our systems are fully prepared for Brexit and we will continue to offer a seamless supply to Europe as we move into 2021.

DHL will make the customs entry for you and advise of any local Tax and Duties prior to delivery. These amounts can be paid directly to the carrier, making the transaction simple and easy for you.

In the meantime, we would ask that any business customers in Europe provide us with their EORI number in the Company Details field when placing an order to ensure smooth customs clearance processing.

If you have any questions or concerns, please do not hesitate to CONTACT US.

Duties and Tax Calculator

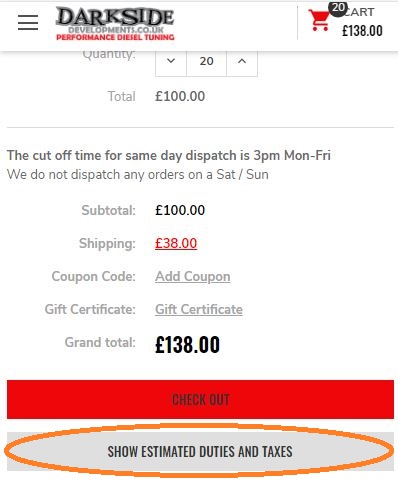

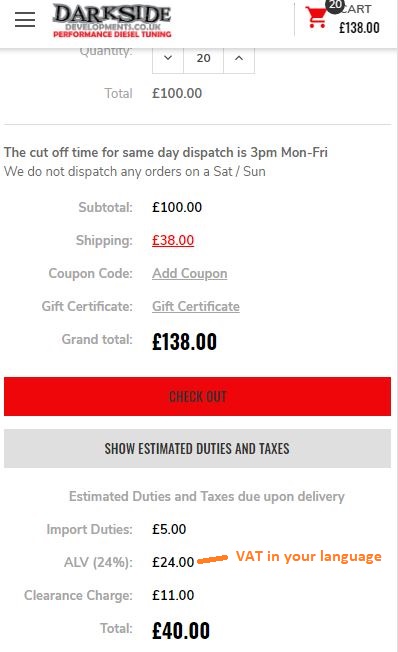

To make things clearer during the checkout phase, we have added a quick calculator to estimate the costs you may have to pay on import:

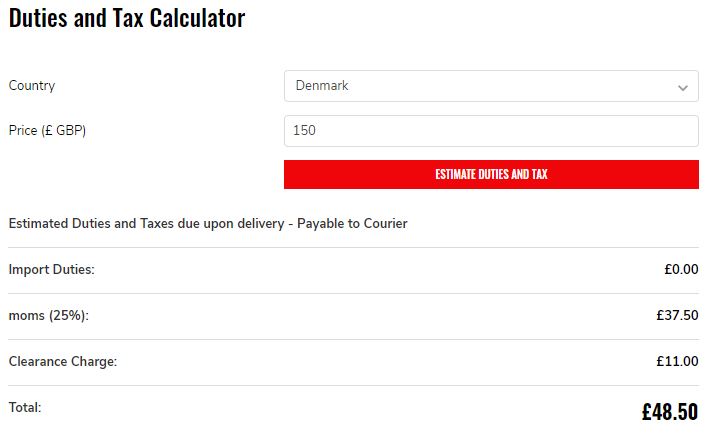

We have also created a standalone Duties and Tax Calculator if you want to estimate without adding items to your cart:

Payment of Duties and Tax

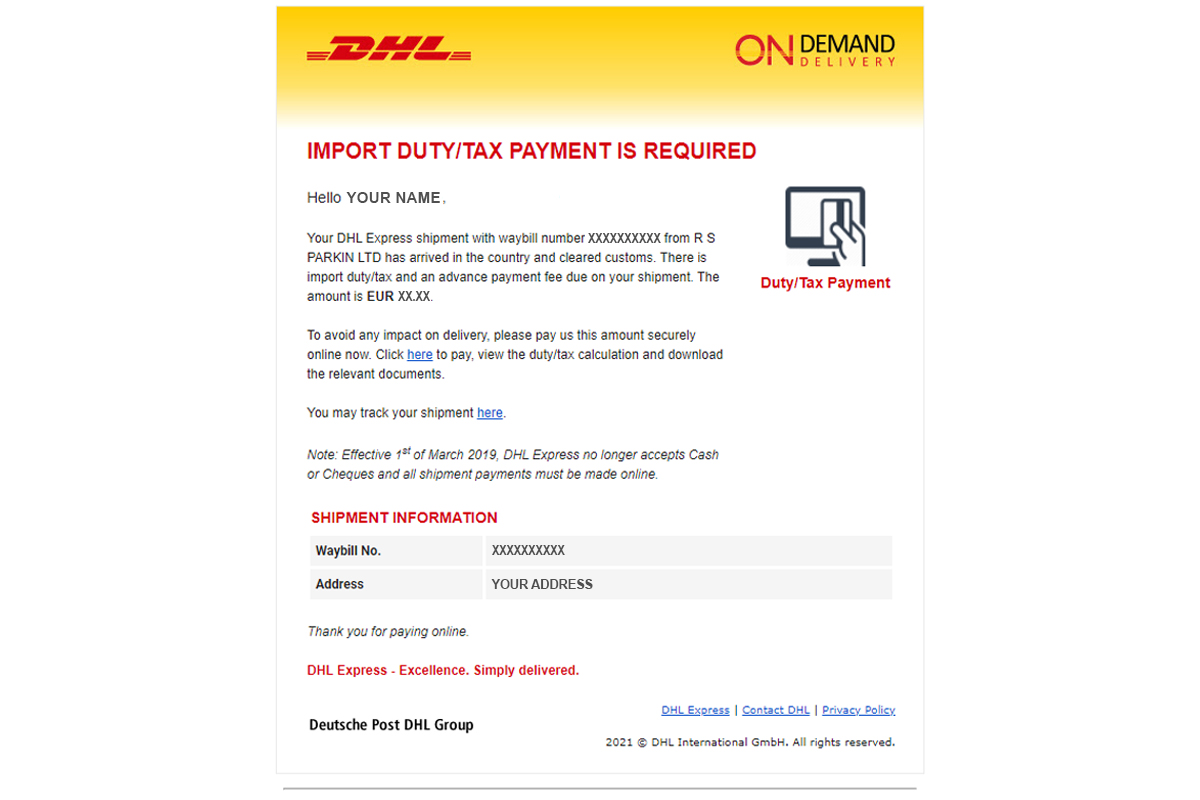

The chargeable duties and taxes will need to be paid to the courier before they will deliver the package to you. If they have an up to date email address for you, they will contact you directly with instructions on how to pay. The name of the sender will show as R S PARKIN LTD which is the legal name of our company.

Example Email:

If you do not have a valid email on file, they may call you or send a letter with a breakdown of the charges.

Example Letter:

They may hold delivery of the package until these charges are paid, and if they are not paid quickly, the package may be returned back to us, at an additional cost to you.

These charges are not for shipping costs, they are paid by the courier directly to your Country's Customs Agency.

DELIVERY TIMES

Will there be any impact on delivery times from 1 January 2021?

We know that delivery times are important and we have taken extensive actions to maintain the usual level of service you receive, including:

- We continue to work with our carriers to secure capacity on import routes into the EU and minimise impact on delivery times so that we can maintain our usual delivery proposition.

- We have invested heavily in our stock levels over the last 12 months. However, there may be some products were we have had to make changes to our supply arrangement and this may result in longer lead times.

- We have prepared our business to be ready to comply with the import and export procedures due to be introduced as far as they have been announced by the UK and EU authorities.

We do anticipate that there may be a short period immediately after 1st January when some delays are experienced as everyone adjusts to the changes in procedures for the movement of goods. We will let you know if we anticipate that your order will be impacted so that you have as much information as possible to help you manage.

IMPORT TAX AND DUTY

Will I have to pay import tax and duty on products despatched from the UK from 1 January 2021?

Following the UK’s exit from the EU, goods moving between the UK and EU member states, as well as other areas of the world, may be subject to additional tariff and duty costs. At this stage the full impact of tariffs is difficult to assess as the UK Government is still negotiating the terms of an exit deal. A full list of affected countries are listed at the bottom of this page. We have also included the local translation for VAT for each.

Will Brexit force my prices to go up due to additional import duties after 1 January 2021?

We still don’t know whether goods moving between the UK and EU member states, as well as other areas of the world, will be subject to additional tariff and duty costs. The broader impact of any additional costs are therefore difficult to assess. Our pricing is based on prevailing factors at any one time. Post-Brexit, our aim is to ensure that customers continue to receive a competitive price whilst maintaining the best service.

CHANGES TO THE WAY WE DO BUSINESS WITH YOU

What changes can we expect in relation to the paperwork and transactions from 1 January 2021?

We will be including invoices on all packages leaving the UK, showing the list of items in the package, the price and Commodity Code for each item. This is how your local Customs will know how much tax and duty must be charged for the import of the package.

As a non-EU business, will you still be able to hold my personal data if I’m located in the EU?

The UK’s rules around data protection will remain aligned with the EU’s General Data Protection Regulation (GDPR), so there will be no change to the way your personal data is kept secure or your rights.

How will I return a product after 1 January 2021?

To open a return, please follow this link - https://www.

How will export controlled goods be managed post Brexit?

Our aim is to maintain existing processes wherever possible.

The EU and UK government have already drafted regulations for simplified procedures and we have applied to use these simplifications.

What impact will there be on my delivery terms (incoterms) after 1 January 2021?

We will do all we can to maintain our current terms. We are introducing arrangements based on information currently provided by the EU and UK authorities.

What us your UK EORI number?

GB994720383000

ACCESS TO PRODUCTS

Will you still offer the same range of products?

We intend to offer our same range of products and will continue to enhance this range with the addition of new suppliers to maximise choice for all our customers.

I am a customer from outside Europe, will I still be able to purchase products after 1st January 2021.

Yes, there are no changes to our processes for customers outside of the EU27 Countries.

AFFECTED EU27 COUNTRIES

| Country | VAT |

|---|---|

| Austria | USt |

| Belgium | BTW, TVA, NWSt |

| Bulgaria | ДДС |

| Croatia | PDV |

| Cyprus | ΦΠΑ |

| Czech Republic | DPH |

| Denmark | moms |

| Estonia | km |

| Finland | ALV, Moms |

| France | TVA |

| Germany | MwSt Ust |

| Greece | ΦΠΑ |

| Hungary | ÁFA |

| Ireland | CBL, VAT |

| Italy | IVA |

| Latvia | PVN |

| Lithuania | PVM |

| Luxembourg | TVA |

| Malta | VAT |

| Netherlands | BTW |

| Poland | PTU, VAT |

| Portugal | IVA |

| Romania | TVA |

| Slovakia | DPH |

| Slovenia | DDV |

| Spain | IVA |

| Sweden | Moms |

Recent Posts

-

Silverstone GP - ClubEnduro - 750MC - 29th October 2023

An unusual calendar for 2023 meant that round 7, the final round of the season for the 750MC Club En …23 11 2023 -

750MC Birkett Relay - Silverstone GP - 28th October 2023

With a hectic season of racing almost to a close, we were back at Silverstone for the 750 Motor Club …15 11 2023 -

Snetterton 300 - BRSCC TTCR - 13th-15th October 2023

For Round 6 of the BRSCC Audi TT Cup Racing, we were at Croft, which turned out to be VERY eventful …20 10 2023